Setting up a well-organized Chart of Accounts (COA) in QuickBooks Online is crucial for accurate financial reporting and efficient business management. A properly structured COA enables you to track specific expenses, streamline reporting, and maintain a clear view of your company’s financial health. In this blog post, we will walk you through the process of setting up a COA in QuickBooks Online, explain the benefits of an optimized COA, and share a free templated COA tailored for service-based businesses and tech startups.

- Setting Up Your Chart of Accounts in QuickBooks Online

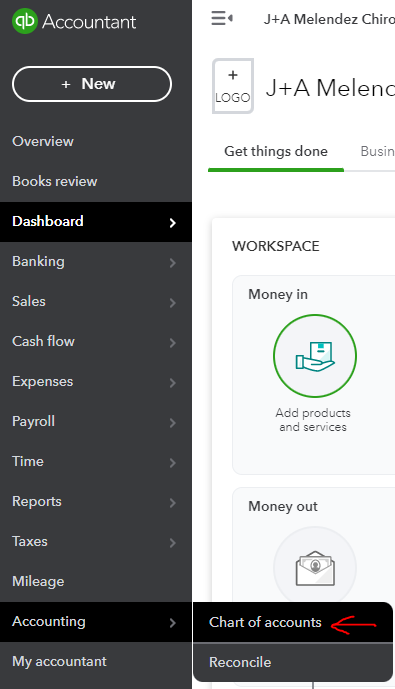

To begin setting up your COA, log in to your QuickBooks Online account and navigate to the Chart of Accounts section by following the image below. If your side menu looks different, start by clicking on the settings cog wheel on the top right and then “Switch to Accounting View” on the bottom right.

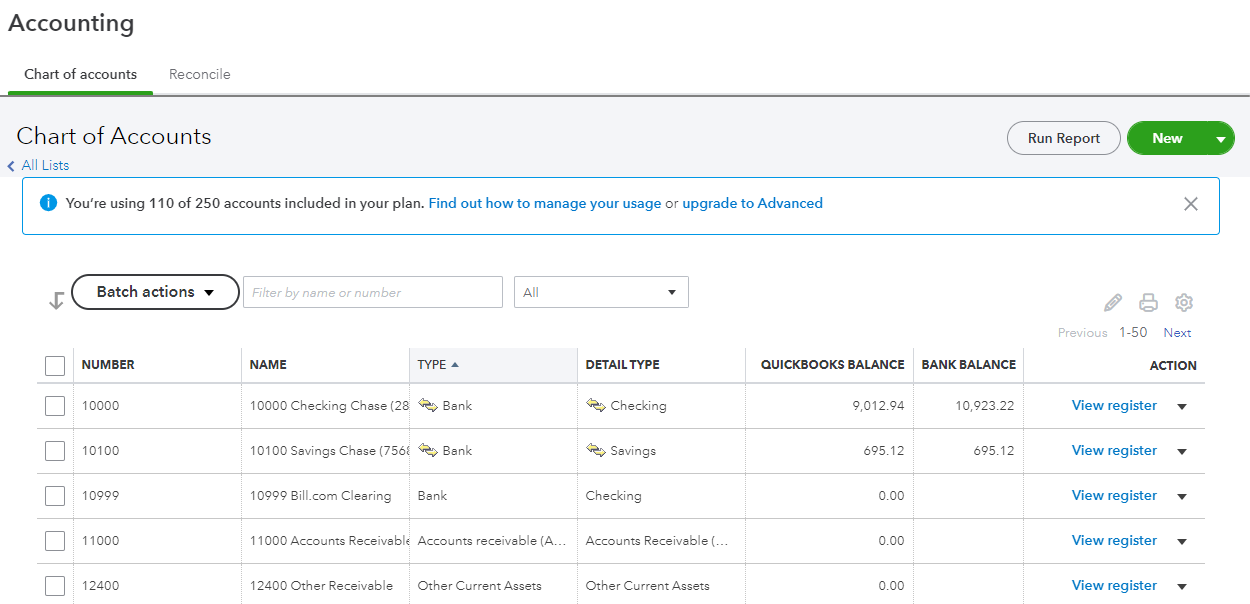

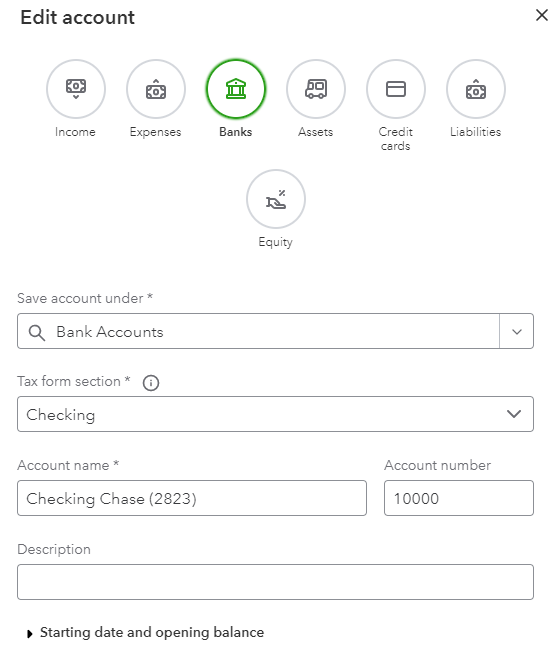

From the “Chart of accounts” screen Click the green “New” button to create a new account, and then follow these steps:

a. Choose the appropriate Account Type and Detail Type, which determine the account’s classification and how it appears on your financial reports.

b. Enter a unique and descriptive name for the account, which will help you easily identify it when recording transactions.

c. Provide a brief description of the account’s purpose, if necessary.

d. Assign an account number, if you’re using account numbering. This can help you maintain a logical order for your accounts.

Repeat this process for each account you want to add to your COA.

- The Order of the Chart of Accounts for the Balance Sheet

In QuickBooks Online, the COA is organized in the order of the Balance Sheet. Accounts are typically arranged in the following sequence:

a. Assets: Current assets (e.g., cash, accounts receivable, inventory) come first, followed by fixed assets (e.g., property, equipment) and intangible assets (e.g., patents, trademarks). They are generally in order of how quickly each item can be turned to cash. For example, the checking account gets listed before a savings account before a money market or CD account.

b. Liabilities: Current liabilities (e.g., accounts payable, short-term loans) precede long-term liabilities (e.g., mortgages, long-term loans). These accounts are listed in order of how quickly they will be paid back. Accounts payable and credit cards will come before accrued expenses and loans.

c. Equity: This section includes owner’s equity, retained earnings, and other equity accounts.

- Striking the Balance: Tracking Specific Expenses Without Overloading Your COA

It’s essential to strike the right balance when setting up your COA. While it’s beneficial to track specific expenses separately, having too many general ledger (GL) accounts can make your COA cumbersome and challenging to manage. To find the sweet spot, consider creating separate accounts for significant or unique expenses that warrant close monitoring, while grouping smaller or similar expenses under broader categories.

Most people will want to break out professional services like accounting, tax services, lawyers and other contractors separately while utilities or online services are grouped together.

- The Benefits of a Well-Organized Chart of Accounts

A well-organized COA offers several advantages, including:

a. Improved financial reporting: A clear and logical COA structure simplifies financial statement preparation and analysis.

b. Streamlined budgeting and forecasting: An organized COA makes it easier to create budgets and projections based on historical data.

c. Enhanced decision-making: By tracking specific expenses, you gain better insights into your business operations, enabling you to make informed financial decisions.

d. Simplified tax preparation: A well-structured COA can streamline the tax preparation process by providing an organized view of deductible expenses and other tax-related items.

Get Your Free Templated Chart of Accounts

To help you get started with your COA setup, we’ve created a templated Chart of Accounts specifically designed for service-based businesses and tech startups. You can download this free template by clicking “Here.” This template will provide you with a solid foundation for your COA, ensuring your financial management is efficient and effective from the outset. You can also use it to get an sense of what order the COA should be displayed.

If you would rather not even mess with the setting up a chart of accounts or your char of accounts is messy and you want someone to help you out let me know. Contact us and we can work on a game plan to get your books all squared away.